I can’t help thinking about an article in the Spring 2014 issue of the magazine published by Heritage Auctions, “Intelligent Collector.” The title of the article was “Collectibles as Investments” and the lead was “Comic Books as a true asset class? Of course, says Mark Prendergast, director of Trusts & Estates at Heritage Auctions (and former vice president at Christie’s). Just look at recent auction sales.”

Putting aside the obvious, self-serving interests here (which are, I grant you, alot to put aside) is there anything to the idea that one can truly INVEST in collectibles – like comic books and illustration art – the way one invests in treasury bonds, equities and real estate? Let’s consider this from a few angles. . . .starting with the state of the art market, and auction sales as barometers of the market.

The Art Market in 2013

According to artprice.com – an online source of art market information – last year “was the best year ever recorded in auction history (over $12 billion), and the best sale ever for Christie’s in its 247 year-old history, achieved by a work by Francis Bacon, with a hammer price of $127 million. In addition, 2013 was marked by nearly 15,000 new records for artists” . . . a splendid year shored up by globalized demand, particularly with buyers from Asia, the Middle East and Russia, who played a crucial role in the market’s fine performance and displayed a voracious appetite for flagship artists of the 20th century”.

The year was also a good one for Heritage Auctions, setting an artist high record for the sale of “Cornered”, the Frazetta Vamp cover from 1970 – a ‘blue chip’ artist in the SF/F genre if ever there was one. Right? These results would seem to support Prendergast’s conclusion that art/collectibles provides grand investment potential – and that there’s no better time than now for jumping in. As he observes “. . The baby boomer generation now has money and wealth, and they are finding that the comics market is a good place to sentimentally, yet wisely, invest.”

But still, I am resistant. It’s hard for me to understand exactly how sentiment and wisdom can be linked without alot of aggravation. In fact, attempts by collectors to act on “nostalgia” while exercising “good judgment” leads to terrible dillemmas. . . precisely BECAUSE they are such polar opposites. Your heart urges “buy” while your head shouts “Stop, you fool!”. 🙂 If you are wealthy enough to treat the purchase as “a lark” – I suppose it doesn’t really matter how much experience or knowledge you apply to the decision. But IF you are investing in art or collectibles with the idea that it’s an “asset or item that is purchased with the hope that it will generate income or appreciate in the future.” (the definition of investment) then really, do you/should you want sentimentality to rule the day? Was the winner of Vamp #5 acting on nostalgia or seeing opportunity for owning an “investment grade” Frazetta?

But maybe that’s not what Prendergast meant. Perhaps he was merely suggesting that: if you’ve got cash that you need to do something with, and CDs are earning a pittance, and purchasing real estate doesn’t turn you on (not to mention requiring more than just a discriminating eye), and precious metals seem too “cold,” and you’ve already got a sizeable portfolio of stocks, you are going to be on the hunt for alternative asset classes to balance your existing holdings….things you can buy that provide some hope of rising in value, while providing some entertainment value. It’s just more fun that way. Whether it’s rare vintage wine, antique jewelry, or fancy Hermes handbags (just to name three other attractive alternative investments to the stock exchange) – if you’ve got the money/wealth, there’s a “collectible” that will have meaning for YOU.

A Rising Tide Lifts all Boats?

” . . . We’re seeing people becoming more comfortable spending thousands to millions of dollars on comic books,” says Prendergast “Heritage sold a 1939 Batman comic book for more than $1 million a few years ago and has since regularly sold key books in the six-figure range in every auction, which shows people are really starting to take note of them.”

Well, actually, people with lots of money are becoming more comfortable buyiing all sorts of stuff . . . PERIOD. To quote from The Guardian “Super Rich Shift their Thrills from Luxury Goods to Costly Experiences” – “They say money can’t buy happiness but the world’s super rich are still giving it their best shot, spending $1.8tn (£1.1tn) last year on luxury goods and services – with extreme holidays, gourmet dining and art auctions (my highlighting) emerging as the status symbols du jour.” And what could be a better status symbol in our field than owning a Frazetta?

If a “rising tide lifts all boats” does it really matter what you are buying, so long as it’s blue-chip, always golden “Frazetta”? Turns out It does matter, because all positive outcomes are being viewed through the lens of a person with 20-20 hindsight.

This is an extremely important point. IN RETROSPECT it certainly does appear that pin-up art – just like the first appearances of Batman and Superman in comic books – were excellent investments. And speaking personally, over the 40+ years we have collected SF/F books and art, those “alternative assets” have done as well, or better, than orher traditional investments we made. BUT I am saying this after forty years. Which is not the same thing as saying: ART is a Commodity which Produces Returns for Investors. It can’t just be “any” Frazetta, just like it can’t be just any pin-up by Elvgren.

Art/Collectibles as Commodities?

Since the turn of the century, “there has been “hype” in art investment funds, and even efforts in 2011 to turn Art into an asset class, traded like REIITs and Gold Stocks or even AT&T” according to a 2012 article in Forbes titled “Could Fine Art and Collectibles Become a New Asset Class?” The short answer? No.

As the Forbes article notes, art funds “are not just insignificant compared with other financial markets but also a very small corner of the $67-billiion-a-year fine art market. Worldwide, fewer than 30 funds are active” . . . (and, quoting an Artvest spokesperson) “half of art funds that are announced never raise enough money to get off the ground.” Most importantly, “even the most successful art funds have yet to prove themselves.” Which is inevitable, if you don’t have a crystal ball! 🙂

When You Do it for Money and Not for Love . . .

The downsides of investing in art funds are clear: you are starting off with negative returns! And all you are actually buying is the hope that someone will want to pay more than you did, later on. (ye olde “greater fool” theory of collecting). Unlike with AT&T, there are no annual returns – but there are considerable, fixed annual expenses (storage, insurance, maintenance, and transaction costs in addition to management fees (2%) plus the 20% profit taking by fund managers “off the top.” ) As the Forbes article explains, succinctly, “In the illiquid, opaque and faddish art market what someone will eventually pay for your painting, print or sculpture is entirely unpredictable, as is the rate at which any given type of art will appreciate or even decline.”

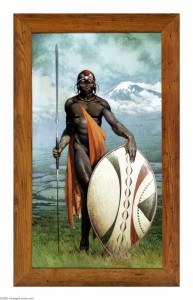

Moreover, it’s one thing to buy a painting and enjoy it – until you are ready to part with it (perhaps at a profit) and quite another to count on profitability in a closed market where you have no control over the timing of the sale…because most art funds are designed to be liquidated in a specific period of time, whether it’s the right time to sell, or not. You are giving control over the buying and selling to “experts” who are long on hype but so far, short on convincing skeptics that buying and selling shares of a Monet or Picasso are a good idea. Moreover: the owner of the Masai Warrior can retreat and wait for another sale; not so, for a fund manager who must liquidate – and finds no buyers.

Interestingly, a survey by Barclay’s (UK) which investigated the motivations of 2000 “high net worth” collectors around the world, found that they still buy fine art (so-called “treasure assets” including fine art, antiques and jewelery) primarily for their own enjoyment, or for cultural or social reasons. In short, while it may be possible to design a fund that would provide sufficient diversification and evolve so that trends in markets can be exploited, it’s still an “unregulated collective investment scheme” that remains unproven in the eyes of most financial observers – despite efforts by art market publications to categorize some art and collectibles as “investment grade.”

In conclusion

The essential problem, from my point of view, in viewing art or any collectible as an “investment” is that you are stuck in the same risky situation as you would be if you had bet on a specific stock and then added to that – the uncomfortable truth that this “stock” has no intrinsic, economic value. It’s not that art or collectibles can’t bring great symbolic and commercial dividends to their owners, it’s just that the myriad factors that you have to weigh, that influence value, can’t easily (if they can be, at all) determined. I can enumerate those factors another time; suffice it to say, for now, that art is not a speculative investment that can be managed like any traditional asset.

1 Comment